-

AI and Accounting: Navigating the Digital Revolution for Success

Embracing Change – How AI is Redefining the Accounting Profession As we navigate the complexities of a rapidly evolving business environment, one thing is clear: Artificial Intelligence (AI) is not just a trend; it’s a transformative force reshaping the accounting landscape. In an era where technological advancements are the norm, accountants must stay current with…

-

Balancing Enterprise Productivity and Cyber Risks: The Dual Impact of AI Integration

How AI and Agents Are an Incredible Opportunity for Enterprise Productivity, But Come with Cyber and Other Risks Introduction The integration of Artificial Intelligence (AI) and autonomous agents into enterprise productivity presents both promising opportunities and significant risks. As organizations quickly adopt these transformative technologies, understanding the dual nature of their impact is crucial for…

-

Balancing Efficiency & Security: Harnessing AI Agents for Enterprise Productivity Amid Cyber Risks

The Dual Edge of AI Agents: Enhancing Enterprise Productivity While Navigating Cybersecurity Perils Introduction Artificial intelligence (AI) and autonomous agents represent a revolutionary opportunity for enterprise productivity. By automating complex tasks and processes, AI agents can significantly enhance efficiency, reduce human error, and free up valuable human resources for more critical tasks. However, with this…

-

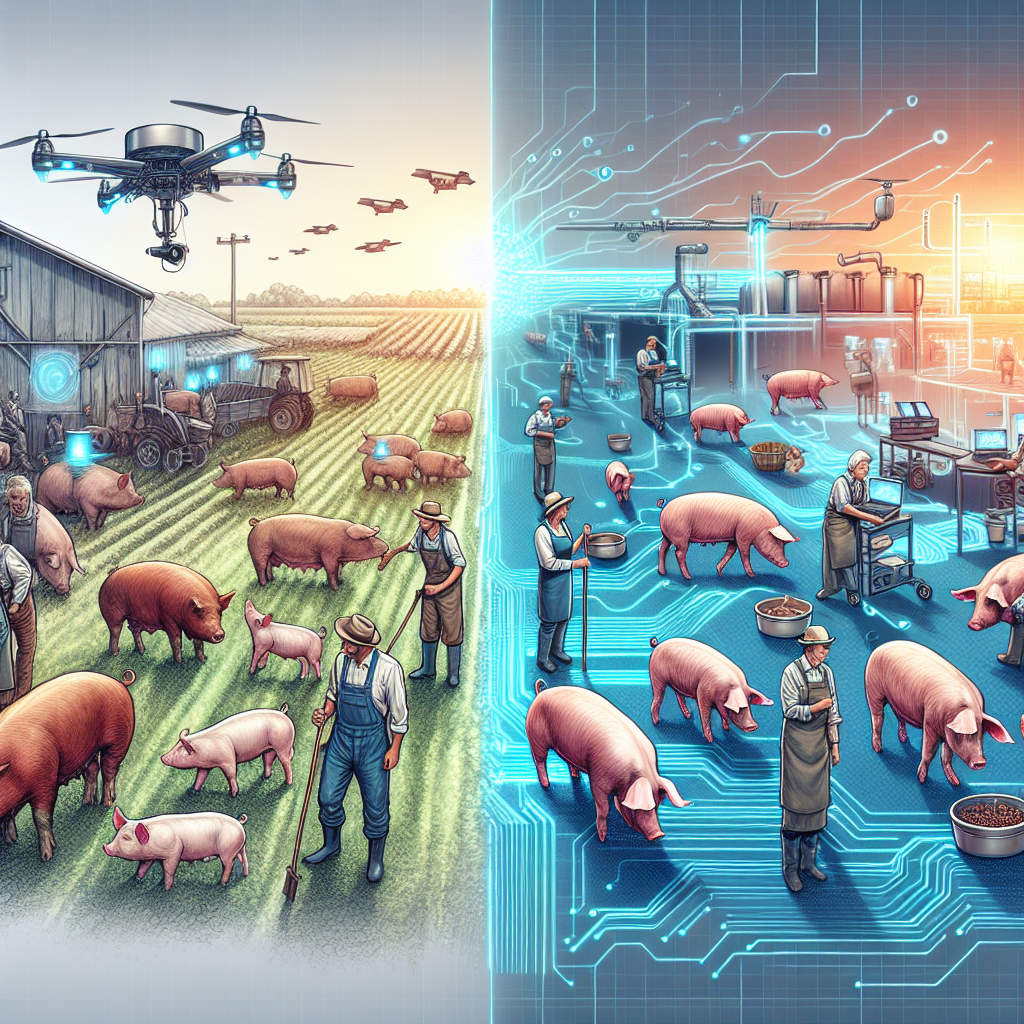

Revolutionizing the Pork Industry: From Artificial Insemination to AI Intelligence – 3 Practical Use Cases

The Evolving Role of AI in the Pork Industry: From Artificial Insemination to Artificial Intelligence The pork industry’s evolution is marked by groundbreaking advancements, particularly with artificial intelligence (AI) technologies. Understanding how AI integrates into various facets of pork production—from traditional methods like artificial insemination to the sophisticated applications of machine learning—can provide valuable insights…

-

AI in the Pork Industry: Transcending from Artificial Insemination to Intelligent Innovations

The Evolution of AI in the Pork Industry: From Artificial Insemination to Advanced Applications The integration of artificial intelligence (AI) in agriculture, particularly within the pork industry, represents a remarkable evolution from traditional practices toward innovative technologies aimed at enhancing production efficiency and profitability. In this blog, we will explore how AI has been defined…

-

Redefining the Pork Industry: Exploring AI’s Role from Artificial Insemination to Artificial Intelligence

Harnessing AI: From Artificial Insemination to Artificial Intelligence in the Pork Industry The pork industry, essential for its contributions to global food security and economy, is undergoing a technological renaissance with the incorporation of artificial intelligence (AI). This blog explores how AI is revolutionizing the pork industry from the early days of artificial insemination to…

-

Securing Your Finances: Navigating Data Breaches in Luxury Retail Giants

Attention Shoppers: The Importance of Vigilance After Recent Data Breaches in Luxury Retail Introduction In recent months, significant data breaches have rocked the luxury retail world, with customers of high-profile brands like Gucci, Balenciaga, YSL, Adidas, Google, Cartier, and Louis Vuitton falling victim to cyber-attacks. As these high-end brands attract a discerning clientele, the sensitive…

-

Unleashing Speed: A Deep Dive into Bell Canada’s Remarkable 5G Network

Bell Canada: The Fastest 5G Network in Canada In the realm of telecommunications, speed and reliability are paramount. As of 2023, Bell Canada has emerged as a trailblazer, boasting the fastest 5G network in the country. This transformation not only positions Bell as a leader but also promises a more connected future for Canadians. In…

-

Harnessing the Power of 5G: Bell Canada’s Domination as the Fastest Network

Bell Canada’s 5G Revolution: Leading the Charge with the Fastest Network in Canada Introduction In the rapidly evolving landscape of telecommunications, Bell Canada has firmly established itself as a leader in 5G technology. For the third consecutive year, Global Wireless Solutions (GWS) has recognized Bell as having the fastest 5G network in Canada. This accomplishment…

-

UK’s Shrinking Population and Inflation Surge: Unravelling Economic Implications

The Impact of Declining Population in the UK on Inflation: A Comprehensive Analysis Overview As the UK grapples with a challenging economic landscape, the interplay between the declining population and rising inflation becomes ever more critical. This analysis explores how these factors interconnect, revealing implications for market trends, investment strategies, and broader economic policies going…