Analyzing Inflation Dynamics in Europe: What to Expect in 2025

As we step further into 2025, understanding the nuances of inflation across Europe becomes imperative for investors and consumers alike. Currently, the Eurozone’s inflation rate stands at 2.2%, slightly above the European Central Bank’s (ECB) target of 2.0%. This situation raises questions—what are the implications for our financial decisions?

Current Inflation Rates

As of April 2025, the inflation rate has surpassed analysts’ initial expectations of 2.1%, with core inflation, which excludes volatile items such as food and energy, rising to 2.7%. This data suggests persistent inflationary pressures that economic policy must address. The implication here is significant, as higher-than-expected inflation can lead to more aggressive measures by the ECB to curb inflationary trends and stabilize the economy.

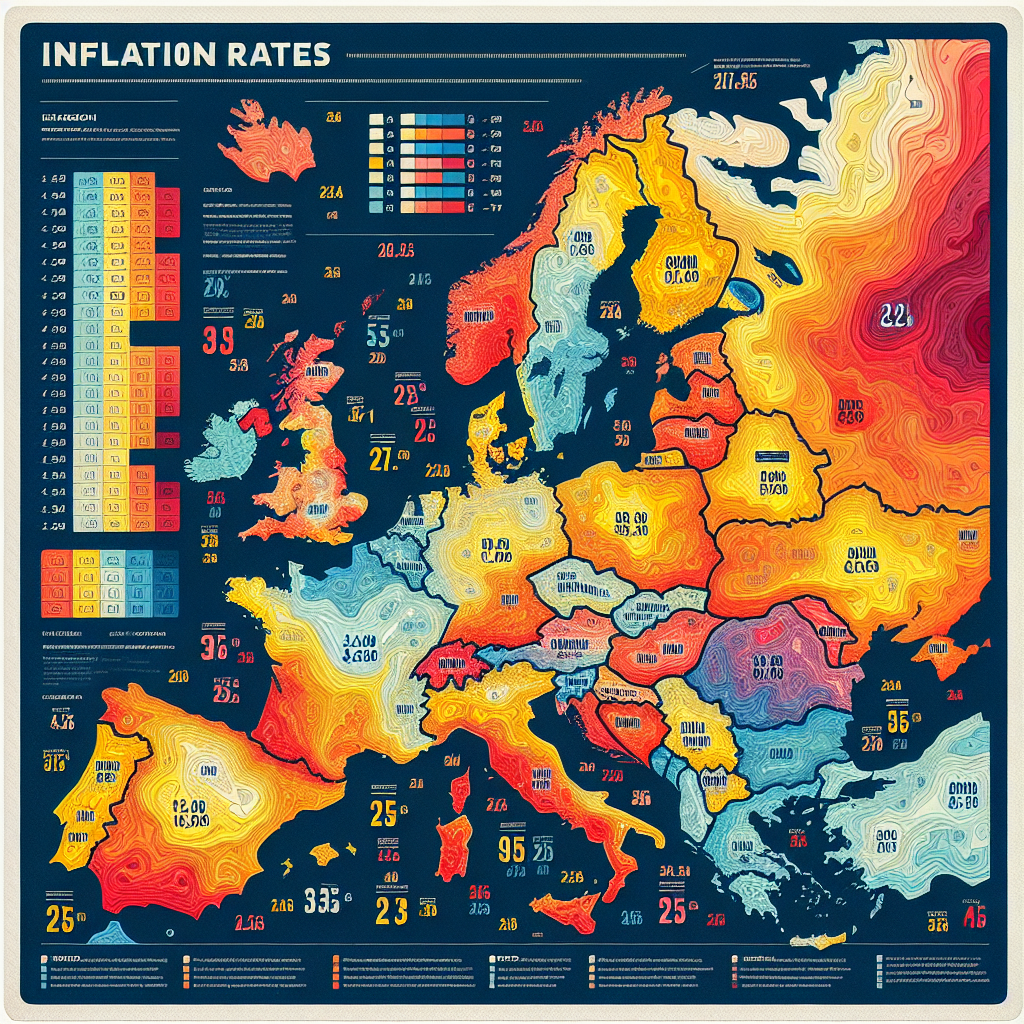

!Inflation Overview

Fig. 1: Eurozone Inflation Rates – April 2025

Sector-specific Trends

-

Services Sector: Recent trends show a notable increase in service inflation, which has surged to 3.9% in April, primarily attributed to seasonal factors like Easter. While these figures may prove temporary due to seasonal spikes, they highlight an underlying trend toward increasing costs in the service industry that could persist beyond the holiday period.

-

Energy Prices: In contrast, energy prices have seen a significant decline of 3.5%. While this decreases immediate inflationary pressures, it could create mixed signals for consumers who adjust their spending behaviors based on energy costs. Understanding these fluctuations is vital for navigating household budgeting and expenditure decisions going forward.

-

Food Pricing: Inflation in food categories, including alcohol and tobacco, has surged to 3.0%. This surge signifies ongoing strains on essential grocery items, potentially affecting consumer spending patterns and dietary choices.

!Economic Outlook

Fig. 2: Inflation Forecast for Mid-2025

Economic Outlook

Experts predict continued volatility in inflation rates influenced by potential U.S. tariffs affecting trade relations. Such uncertainty suggests cautious spending habits among consumers, which could, in turn, impact broader economic activity. This creates a challenging environment for businesses and policymakers, as they must adapt to fluctuating inflation rates and changing consumer confidence.

Market analysts also point out that sustained inflationary pressures might prompt the ECB to review its interest rate policies. These decisions will be closely monitored by investors and consumers alike, as they have immediate implications for loans, mortgages, and investment strategies.

Market Sentiment

Despite stable inflation, continued rates above the ECB’s target can lead to investor skepticism. This sentiment can particularly affect decisions within equity markets and commodities. As inflation impacts different sectors unequally, shifts in fiscal policy—such as Germany’s substantial infrastructure projects—may further complicate economic forecasts.

It’s essential for businesses and consumers to remain informed about these shifts, as they can lead to changes in market confidence and investment decisions. Stakeholders should consider diversifying their portfolios in response to these evolving inflation dynamics.

What Should Consumers Do?

As inflation remains a pivotal topic in 2025, consumers should stay vigilant about how these economic shifts affect their financial landscape. Monitoring changes in the ECB’s monetary policy, especially potential rate cuts, could provide opportunities for lower mortgage rates, impacting home loans and investment avenues.

Planning effectively for the upcoming shifts may empower consumers to make proactive financial decisions, ensuring they are not caught off guard by sudden changes in the economic climate. Understanding the broader implications of inflation on purchasing power and savings can help consumers navigate these complexities.

Conclusion

Inflation dynamics in Europe are complex, intertwining economic factors, consumer behavior, and policy considerations. Staying informed and adapting to these changes can help investors and consumers make proactive financial decisions.

By dissecting sector trends, understanding the broader economic outlook, and acting accordingly, stakeholders can better position themselves in a potentially volatile financial environment.