Understanding Inflation in Europe: Insights for 2025

Inflation Trends in the Eurozone

As of April 2025, the Eurozone is experiencing a stable inflation rate of 2.2%, slightly down from 2.3% in February. This trend aligns closely with the European Central Bank’s (ECB) target, aimed at maintaining inflation around 2%. However, the core inflation rate has risen to 2.7%, indicating persistent inflationary pressures largely driven by services and wage growth.

Key Data at a Glance:

- Eurozone Inflation (March 2025): 2.2%

- EU Inflation Rate: 2.5%

- Lowest Inflation Rate (France): 0.9%

- Highest Inflation Rate (Romania): 5.1%

- Recent ECB Interest Rate: 2.25% (cut of 25 basis points)

Key Influences on Inflation

-

Core Inflation Insights: The rising core inflation suggests sustained demand in the services sector despite broader economic challenges. This sector, crucial for overall inflation, is showing resilience, hinting at consumer confidence in certain areas. Higher wage levels indicate that businesses are increasing pay to attract and retain talent, contributing directly to service cost escalations.

-

ECB Monetary Policy Adjustments: In April 2025, the ECB reduced interest rates to accommodate these inflation dynamics. ECB President Christine Lagarde has adopted a cautious, data-dependent approach to any future adjustments, highlighting the need for close monitoring of economic indicators. Analysts are closely observing how these policy shifts will affect borrowing costs and spending power across the Eurozone.

-

Investment Landscape: For investors, the stable inflation implies potential for market volatility, particularly in sectors sensitive to interest rate changes. Investors should remain observant of how inflationary implications shape monetary policy and, consequently, market dynamics. Diversifying portfolios and considering inflation-hedging strategies may become increasingly crucial as the landscape evolves.

Economic Outlook for 2025

Despite stable inflation, Europe faces cautious economic growth, with GDP reported at 0.4% in the first quarter. However, uncertainties such as trade tensions and global economic conditions may impact this trajectory. Investors are advised to monitor signs of consumer confidence and spending, which are pivotal in shaping inflation trends. Economic indicators suggest that while the situation is currently stable, fluctuations could arise from external economic pressures.

Blog Post Ideas

1. Title: “Navigating Inflation: What European Investors Must Know for 2025”

Content:

Explore how inflation impacts investment strategies in Europe this year. With ECB’s interest rate adjustments and a diverse economic landscape, investors must adapt to shifting dynamics. Assessing the sectoral impact across diverse industries will crucially inform decision-making processes.

2. Title: “The Role of Services in Europe’s Inflation Puzzle”

Content:

Delve into how services influence inflation rates across Europe. Highlight specific sectors experiencing increased demand and how they might shape monetary policy outcomes. By focusing on trends in consumer behavior, investors can glean valuable insights into future market movements.

Social Media Updates

-

Tweet:

📊 As of April 2025, Eurozone inflation is steady at 2.2%! However, core inflation has climbed to 2.7%. Investors should stay alert to ECB policy changes! #Inflation #Eurozone #InvestmentInsights -

LinkedIn Post:

🚨 Important Update for 2025! The ECB’s recent decision to lower interest rates illustrates their proactive approach to managing inflationary pressures. Stay informed on how these developments could affect your investment strategies in the Eurozone.

Infographic Ideas

-

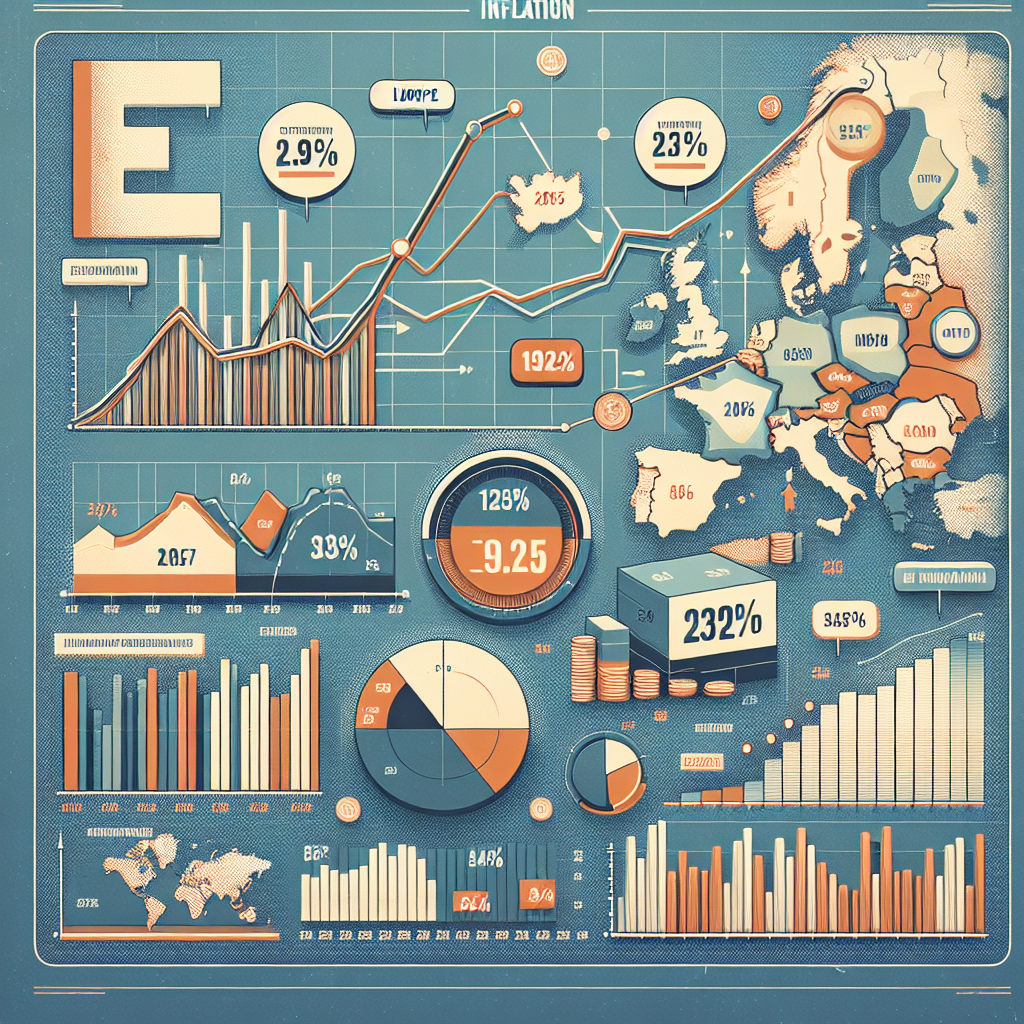

Title: “Inflation Rates Across Europe: A 2025 Overview”

Description: Visual representation displaying inflation rates by country, illustrating regional disparities in a clear, engaging format. -

Title: “Interest Rate Changes and Inflation Trends: What to Watch”

Description: Chart depicting the trend of inflation against ECB’s interest rate adjustments, highlighting critical moments that impacted market decisions.

Conclusion

As we navigate through 2025, stakeholders must keep a vigilant eye on inflation indicators and ECB policies that could reshape the investment climate. The interplay of inflation rates with monetary policy adjustments represents both opportunities and challenges for savvy investors looking to align their strategies with the evolving financial landscape in Europe.

By integrating these insights, data visualizations, and engaging content formats, we can effectively educate and inform our audience navigating the complex world of European inflation in 2025.